Welcome to

Cyla

Cyla is building a complete DeFi intelligent investment decision-making engine by integrating multiple specialized AI agents, aiming to be a leading AI-driven on-chain investment management platform in the cryptocurrency market.

Multi-AI agent Harmonious Framework

Multiple AI agents complete division of labor and collaboration according to the workflow

Roles&Responsibilities

-

Researcher:

Integrates information from all analysts and compiles comprehensive research reports.

-

Trader:

Executes specific trading operations on DeFi platforms and adjusts trading strategies flexibly.

-

Risk Analyst:

Assesses the risk level of investment portfolios and formulates risk control strategies.

-

Fund Manager:

Synthesizes information and recommendations from all AI agents to make final investment decisions.

Roles&Responsibilities

-

Fundamental Analyst:

Conducts in-depth research on fundamental factors to evaluate the long-term value of projects.

-

Sentiment Analyst:

Monitors investor sentiment and analyzes how sentiment changes impact asset prices.

-

News Analyst:

Tracks real-time policy updates in the DeFi space.

-

Technical Analyst:

Utilizes technical analysis tools and indicators to forecast future price fluctuations.

Information Collection and Transmission

Cyla's AI Agents ensure scientific and effective decision-making through rigorous information collection and transmission sequence

-

Information Collection:

Analysts gather fundamental data, investor sentiment data, news information, technical analysis data, and more.

-

Preliminary Analysis and Transmission:

Each analyst generates their own analysis reports or charts and passes them to the Researchers.

-

Comprehensive Research and Transmission:

Researchers compile comprehensive research reports and pass them to Risk Analysts and fund Managers.

-

Risk Assessment and Transmission:

Risk Analysts produce risk assessment reports and deliver them to Fund Managers.

-

Final Decision and Execution:

Fund Managers make the final investment decisions, and Traders execute and provide feedback

Future Outlook

The integration of AI agents and Web3 is expected to drive market development on multiple levels. First, AI agents will improve operational efficiency through automated, smart contract-driven interactions. This will simplify processes and reduce user transaction costs. Second, Web3’s token economic models will empower AI agents, enabling them to capture value in decentralized markets. This will create fairer mechanisms for profit distribution.

Automated Financial Services

Decentralized Governance

Personalized User Experiences

Cross-Chain Interoperability

Enhanced Security and Privacy

Privacy Security

Protecting AI Agent data and computing privacy through TEE and MPC

Trusted Execution Environment

- Data encryption storage and transmission

- Access control

- Data desensitization

- Anonymous communication

- Data traceability

- Hardware-level isolation

- Multi-party secure computing and federated learning

Secure Multi-Party Computation

- Protect the data privacy of participants

- Ensure the correctness of calculation

- Controllable and auditable operations

- Support multi-party

- Applicable to multiple scenarios

- Reduce data sharing risks

- Enhance the credibility of AI Agents

Initiator

Cyla is a laboratory project jointly supported by the Public Investment Fund, Al-Munifat Commercial and King Saud University.

| The Public Investment Fund (PIF) of Saudi Arabia, established in 1971, is the country’s primary sovereign wealth fund and one of the largest sovereign wealth investment funds in the world. PIF aims to represent the Saudi Arabian government in making strategic investments and financing business projects that hold significant importance for the nation’s economic development. |

| Al-Munifat Commercial is a globally active energy company with core businesses in petroleum product trading, energy development, and the construction of related projects, including large-scale integrated petrochemical complexes. The company boasts a robust global supply chain mechanism capable of meeting diverse client needs. |

| King Saud University (KSU), established in 1957 and located in the capital city of Riyadh, is the highest-ranking academic institution in Saudi Arabia. The Department of Computer Science at KSU is a key part of its science and engineering disciplines, dedicated to cultivating talents in the field of computer science. |

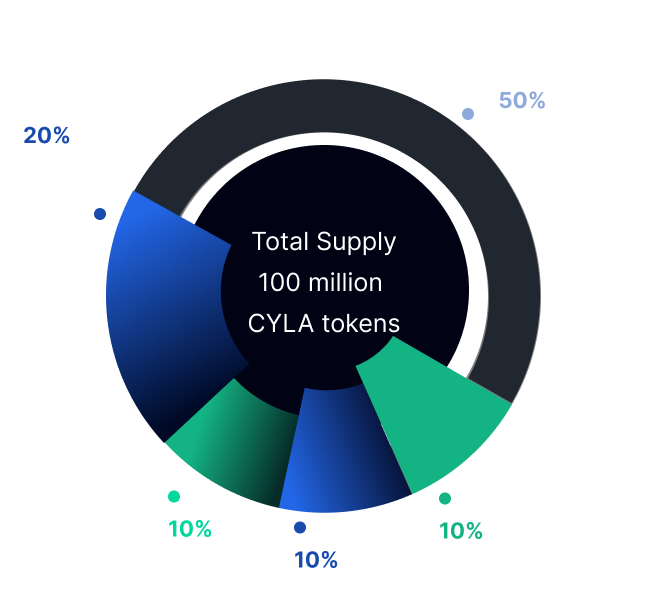

Token

Name:Cyla

Issuance Platform:Binance Smart Chain

Token Use Cases

Unlocking Premium Services:Users pay CYLA tokens to access advanced AI agent services.

Governance Rights:Token holders have governance and decision-making rights.

Incentive Mechanism:Tokens can be used to incentivize developers and users.

Token Value Capture

-

Premium Service Fees:

•A portion of these tokens will be destroyed, while the rest is allocated to foundation management.

-

Repurchase and Burn:

The project periodically uses profits to repurchase CYLA tokens from the market and destroy them.

-

Liquidity Mining:

Encouraging users to deposit CYLA tokens into liquidity pools. The project rewards liquidity providers regularly.

-

Transaction Fees:

•Part of fee is used for CYLA token repurchase, while the remainder supports foundation operations.

Value of AI Agents

-

Precise Market TrackingReal-time data allows trading AI agents to capture subtle market fluctuations. For example, in the cryptocurrency market, prices can experience significant swings in a short time. With integrated API interfaces, AI agents can fetch the latest price data instantly. When Bitcoin’s price surges by 5% in a short span, AI agents can detect the change and analyze the reasons behind it, such as major positive news or shifts in supply and demand. This precise market tracking enables AI agents to adjust strategies promptly, seizing buying opportunities during an uptrend or selling at a peak for profits.

-

Optimized Trading DecisionsReal-time data provides a robust basis for trading decisions. A technical analyst AI agent can use real-time trading data, such as K-line charts and volume indicators, alongside technical analysis tools and models. For instance, by calculating the Moving Average (MA), the agent can identify trends. A “golden cross” occurs when the short-term MA crosses above the long-term MA, signaling a buy opportunity, while a “death cross” signals a sell opportunity. Constant data updates ensure AI agents continuously refine these technical indicators, enhancing decision accuracy.

-

Capturing Market Sentiment and TrendsSentiment analysis AI agents leverage API integrations with social platforms to monitor investor sentiment in real time. In the crypto market, sentiment significantly impacts asset prices. For example, if Twitter shows heightened interest and positive sentiment toward a new DeFi project, it could indicate an upcoming token price surge. Sentiment analysis agents can analyze social media text data using natural language processing (NLP) to detect sentiment trends. If positive sentiment spikes, the agent relays this to the trading system to initiate early asset purchases, reaping gains as market sentiment drives price increases.

-

Rapid Response to Market EventsNews analysis AI agents use API integrations with media platforms to track industry news in real time. Regulatory announcements or security breaches on exchanges can significantly impact the market. For instance, if a country suddenly enforces stricter crypto regulations, it may trigger panic selling. The news analysis AI agent can detect such news immediately, assess its impact, and guide trading AI agents to act swiftly. Selling negatively affected assets reduces losses, while acquiring those likely to benefit from capital shifts captures new opportunities.

-

Enhanced Trading Efficiency and CompetitivenessReal-time data acquisition and processing dramatically improve the efficiency of trading AI agents. In high-frequency trading, even slight delays can alter outcomes. Through API integration, AI agents can fetch market data with minimal latency and respond quickly. For example, in liquidity mining, AI agents can adjust strategies dynamically based on real-time rewards data and asset price changes, selecting the most profitable assets and platforms to maximize returns. This efficiency allows Cyla’s intelligent investment engine to stand out in the highly competitive crypto market, delivering greater returns for investors.